My mom tells the story of how when I was a little girl I kept track of my money according to which bedroom drawer it sat in. Second dresser drawer from the bottom housed the money I saved for my Hello Kitty products. In my night stand drawer, I stashed away a few bucks for snow cones. I had as many savings spots as there were drawers in my bedroom and wishes in my head.

As I got a little older and my taste changed, those extra dollars I horded in my sock drawer instead went into a bank account. What didn’t change was always knowing how much was in there and where the money was being spent.

Ok, so you’re not a numbers nerd like me, but it’s a new year and it’ the perfect time to start getting financially organized. I’m not suggesting you hide money under your mattress or in drawers but first you need to set your 2019 financial goals. And even before that you need to make sure you understand your finances.

But how?

Don’t be afraid to look at the numbers. Rather than putting it off and hoping your finances are in good control, start getting financially organized by answering these questions:

- Do you know how much you spend each month?

- Do you know much you have in savings?

- Do you know how many accounts you have open?

- Do you know how much debt you have?

If you answered no to any of these questions, it’s time to make a change.

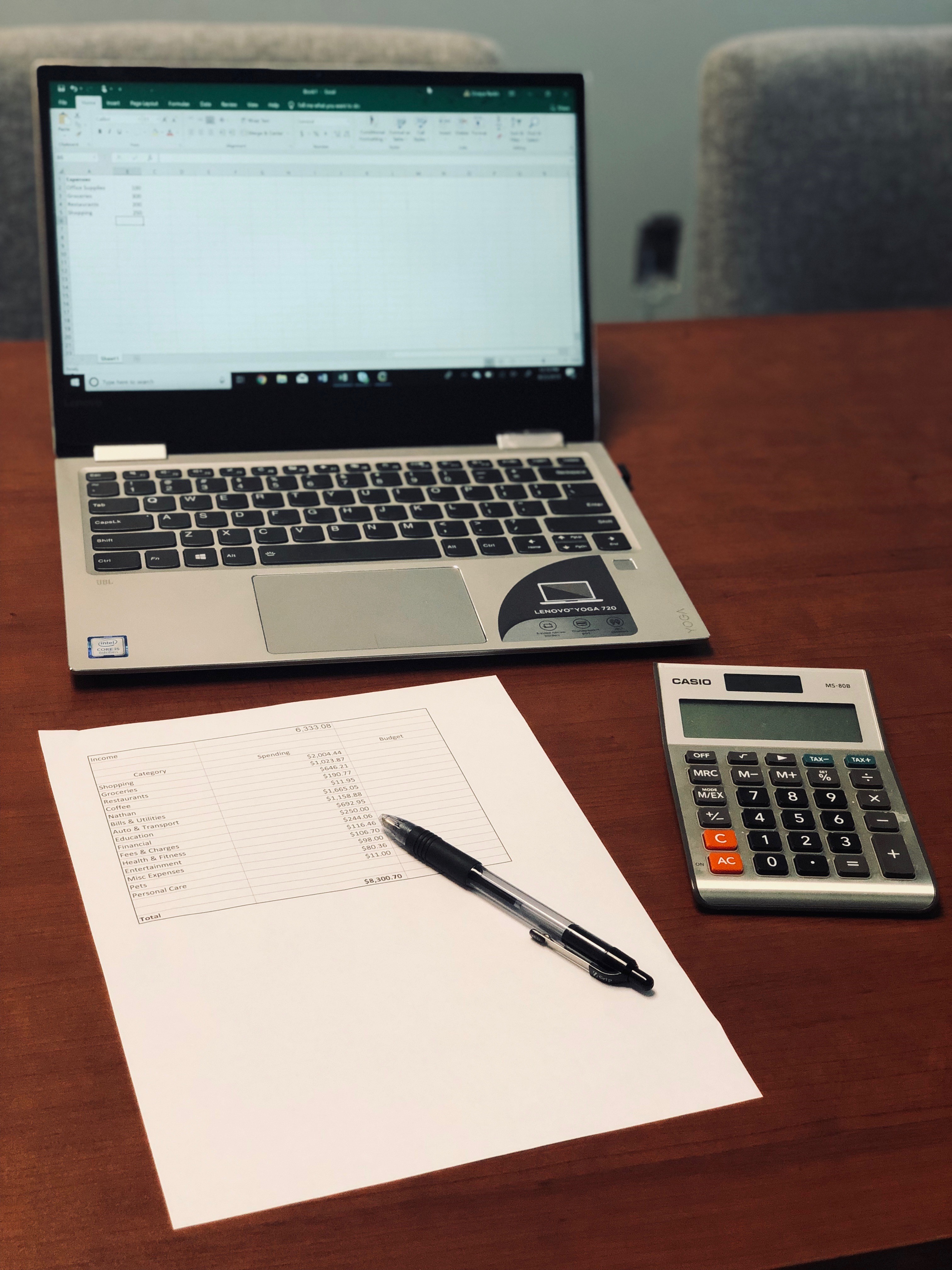

I’ve tried many different methods for organizing and tracking finances. They run the gamut from using paper and pencil to spreadsheets to online tracking websites to Quickbooks, I’ve tried them all. Not every method will work for every person so it’s important to find what works for you and stick to it.

Here are some Centsible steps to help you get financially organized.

PAPERWORK ORGANIZATION

- Gather all papers to figure out how many accounts and bills you have

- Choose paperless statements to reduce clutter

- If you prefer to use paper, use file folders to keep papers organized

MAKE A LIST

- Accounts- Make a list of all accounts you have including:

- Checking

- Savings

- Money Market

- Retirement

- Any other accounts you may have

Having too many checking and savings accounts leads to confusion and more things to keep up with. If you can consolidate accounts, then do so. Less accounts can help reduce fees.

- Bills- Make a list of all your bills and how much you are paying

Go through bills and make sure you aren’t paying for things you don’t use

For example, are you paying for a gym but not going?

It may be time for a new cable company or energy company, do some research. The savings may be startling.

- Debt- Make a list of all debt

What is the monthly payment and when is it due?

Do you have a plan for repaying this debt?

TRACKING

- To me, this is the most important step. It’s almost impossible to keep up with your accounts, bills, expenses, etc. without tracking them on a regular basis.

- Pick your preferred tracking method.

- Not a computer person? You can always track with pen and paper.

- A spreadsheet is a good way to track but you will have to manually input everything and maintain the spreadsheet.

- An easier option would be to use free online tools such as Mint.com or PersonalCapital.com.

- These sites will you allow you to link your bank account and credit cards, track expenses, create budgets, and more.

- Software programs are also good, but you will have to purchase them.

- Quicken or Quickbooks will allow you to track with a lot of detail.

- Expenses

- Tracking expenses allows you to have a better understanding of where your money is going. You may be surprised at how much those daily Starbucks add up over a month.

- Organize your expenses into categories and monitor closely what you are spending.

- This will allow you to review and decide where you can cut back if needed.

BUDGET

- Once you track your expenses and have a better idea where your money is going you can create a budget to help meet your financial goals.

- Find ways you can cut back on discretionary expenses so you can either pay off debt or start saving more.

SCHEDULE TIME FOR YOUR MONEY

- Set aside a specific time once a week to go through your accounts and bills and make sure everything is on track

- Assess how much you are spending and if you are on track for your budget

Tracking and getting financially organized will help you reach your financial goals and help you create wealth. Start 2019 with a Centsible Plan for financial organization and make it a goal to maintain throughout the year!

Disclaimer: The information on this blog is for educational and informational purposes only. We recommend you consult with a financial professional before making any financial decisions.